Lord Mayor’s Charitable Foundation’s strategic asset allocation maintains both growth and defensive assets. The change in its investment allocation and strategy to a more institutional quality investment model over the past three to four years, with greater diversification, has put the Foundation in a sound position during these uncertain economic times.

The Foundation’s Investment Committee in consultation with its Asset Allocation Advisors, Frontier, monitor the Foundations’ portfolio closely on a monthly basis. During March and April, the portfolio was monitored on a daily basis as we encountered unprecedented volatility in investment markets all over the world.

The spread of COVID-19 and the concurrent effect on global economies due to the shut down of economic activities culminated in sharp falls in equity markets globally.

The Australian All Ordinaries Index fell to a low of 4,564 by 23 March, a 37% fall from the all-time high of 7,255. The magnitude and speed of the market fall as well as the lock down in global economies, led to a mass of unprecedented emergency government spending and monetary policy measures to support economies throughout the world. These efforts helped to settle the investment markets somewhat in the month of April.

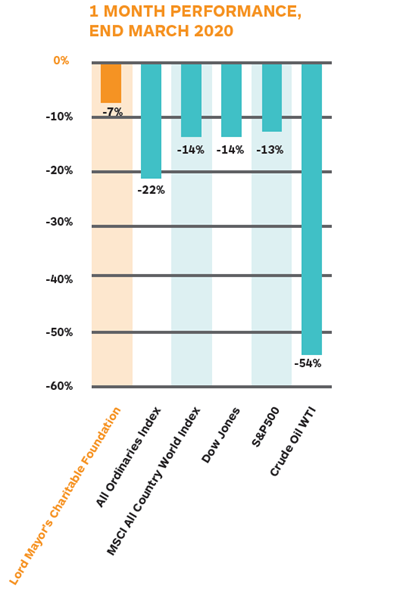

At Lord Mayor’s Charitable Foundation, our investment portfolio was resilient and weathered the turbulent market relatively well. The Foundation registered a 7% decline in value in the month of March. This compares very favourably with a 22% fall in the All Ordinaries Index and a 13% decline in the S&P500. The strategy to hold on to high levels of cash prior to the market meltdown worked in our favour. We were able to opportunistically add to our equity positions during the sharp correction.

It is still early days yet, with the economic impact of COVID-19 likened to the Great Depression. However, we believe that a cautious approach during these unprecedented and volatile times, together with a diversified portfolio, will position the Foundation’s investments to weather the economic uncertainty.

The Foundation’s transition to a spending policy and methodology has enabled the Foundation to respond to disasters in the community swiftly and maintain grant distributions during the bushfires and current COVID-19 crisis. The spending methodology will smooth out the level of grant distributions for current and future beneficiaries over the long term. The development of the Foundation’s spending policy sits within the overall investment risk appetite and investment risk budget. This spending policy will reduce granting volatility over periods of time, whilst also monitoring the overall investment corpus is growing in real terms relative to inflation.

We remain vigilant and nimble and look to deploy capital when opportunity arises. It is important to take a long-term view on investing in order to maintain the future granting ability of the Foundation.

Darren McConnell

Chief Financial & Operations Officer